My fascination with technology combined with shopping for a new home safe began an educational journey into the world of protecting valuables which subsequently turned into a great blog topic. After doing some extensive research on our own purchase, interest in how the wealthy protect their physical investments was peaked. While studying the many facets of this subject, I happened upon a company called Vault@268 in Singapore that resembled a Mission Impossible blockbuster with the incredible amount of robotic technology and layers of security ensuring both the upmost in privacy and security for their clients.

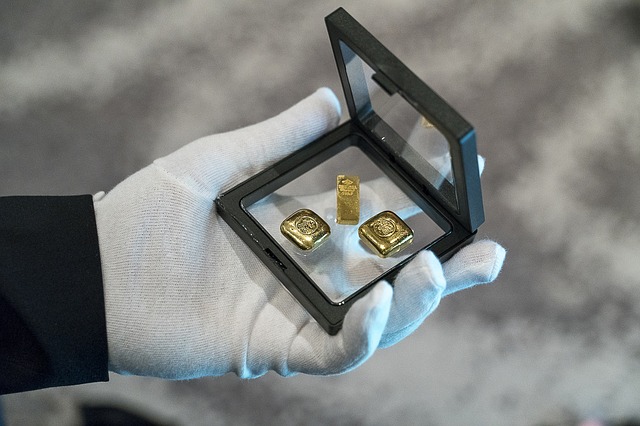

For collectors of precious metals, gold holds the title as the standard-bearer as one of the safest investments, especially in times of uncertainty, as it is less volatile and will buy gold to counter sustain losses in stocks, bonds, real estate, and other traditional investments. In the era of Covid-19 and economic global uncertainty, gold prices are slowly yet steadily rising, creating an increase interest for both investors desiring diversification or survivalists looking to stock away gold and silver for worst-case scenarios including a currency devaluation to have the ability to trade for essentials (groceries, gasoline, etc.)

Besides physically buying gold, investors can:

– Buy exchange-traded funds (ETFs) and exchange-traded commodities (ETCs) vehicles that allow an investor to track the underlying price of gold without having to physically hold the asset.

– Buy related stocks of companies directly linked to gold such as gold miners or gold producers

– Invest in alternative vehicles such as gold-backed cryptocurrencies or foreign exchange trades

All three have risks involved that a buyer doing due diligence in weighing the pros and cons.

Storage of Physical Gold

When it comes to buying physical gold, experts advise devising a strategic plan as to storing gold as there are only three ways 1) store at home 2) store in bank’s safe deposit box 3) hire a third party storage facility.

Your Home

-Advantages: It will be readily accessible to you in the case of banks closing, internet shuts down or the world or nation experiences some type of economic meltdown

-Disadvantages: It’s potentially accessible to thieves – unknown or known

A few tips to consider if this is the route you’ve decided to take:

1. Only have one trusted confidant. The more people know, even if unintentionally (family members, the safe installation company, insurance agents, etc.) the greater the risk

2. Determine if your lifestyle could make you a target

3. Insuring your gold breaks the one trusted confidant rule and insurance on gold is costly and most insurance plan may not cover the full value

4. When planning a hiding place, experts suggest staying away from the obvious (i.e, fake books with secret storage), think like a thief, consider decoys, create layered hiding places, use more than one hiding space (floorboards, aquariums, etc.); Panic rooms; backyards can be used but keep in mind keeping track of where its buried, neighbors watching, type of container

5. Alarms and Safes – install video camera systems to record and monitor with the ability to immediately alert law enforcement; consider a heavier safe and be sure it’s fire and water damage proof

6. Only keep small quantities of gold at home in the case of natural disasters (floods, earthquakes, wildfires, tornados, etc.) that you have absolutely no control over and potentially lose everything.

Bank’s Safety Deposit Box

-Advantages – Physically safer

-Disadvantage – Not as accessible as you are on the bank’s timetable, riskier in moving your valuables, liable to be confiscated along with every other box in a criminal investigation; professional theft operations; safe deposit boxes are not FDIC insured

Third-Party Storage

-Advantages – greater security than a home or a bank; the gold will have gone through the assay process to determine quality and liquidity for easier trading; gold and other precious metals will be underwritten by a reputable insurer such as Lloyd of London

-Disadvantages – Immediate nearby access to the physical bullion, yet some storage facilities allow for precious metals trading

Consider:

1. The vault or depository’s reputation by talking to other investors

2. Storage facilities should do third party audits, offer unlimited online access to their personal records.

3. The facility should guarantee delivery of an investor’s gold by armored car in a relatively short period of time

4. Whether a facility allows an owner to take loans against their stored goal

5. An investor needs to consider the cost of service and the jurisdiction of the provider. For instance, Singapore is known as one of the safest countries in the world for the storage of gold bars and coins due to the government actively supporting and promoting their country as the hub for trading and storage. There are no reporting requirements on buying, selling, or storing and also no sales taxes, or any taxes with regards to gold purchasing. Other countries that are deemed friendlier for gold and precious metals investors and high net worth individuals are the Cayman Islands, Switzerland, New Zealand, Panama, and Austria.

Most advisors suggest diversifying in all three areas for flexibility, accessibility, and long term protection and ultimately peace of mind. -AJ

Share Your Thoughts in the comment box below or on Twitter!

A huge thank you to the following sources for their educational input:

CNBC – Is now a good time to buy gold

GoldSilver.com – How to Store Gold At Home

Bullionstar.com – Ways to store gold

NomadCapitalist.com – Best countries for offshore gold storage

Hat Tip to the Following photographers:

Swapnil Bapat – Singapore

Linda Hamilton – gloved hand holding gold

Ulrich Dregler – gold bars

Matthias Wewering – single gold bullion

Reimund Bertrams – Vault Door

Krocker Klaus – Safety Deposit Boxes

Boris Stefanik – Lloyd of London

Irina Kukuts – Aquarium

Walter Freudling – Silver Bars

Makingmilly – precious metal coins

Simon – coins on wooden table

SHARE POST

Customer Favorites